Lost Wages and Loss of Earning Capacity in Personal Injury Cases

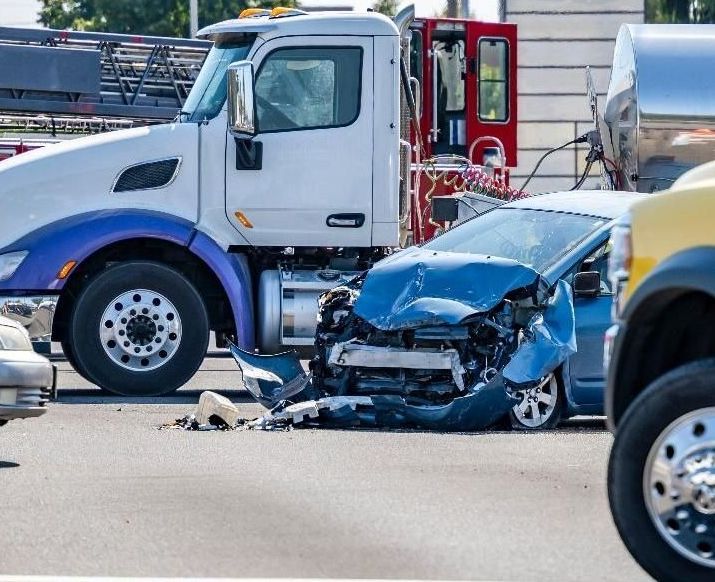

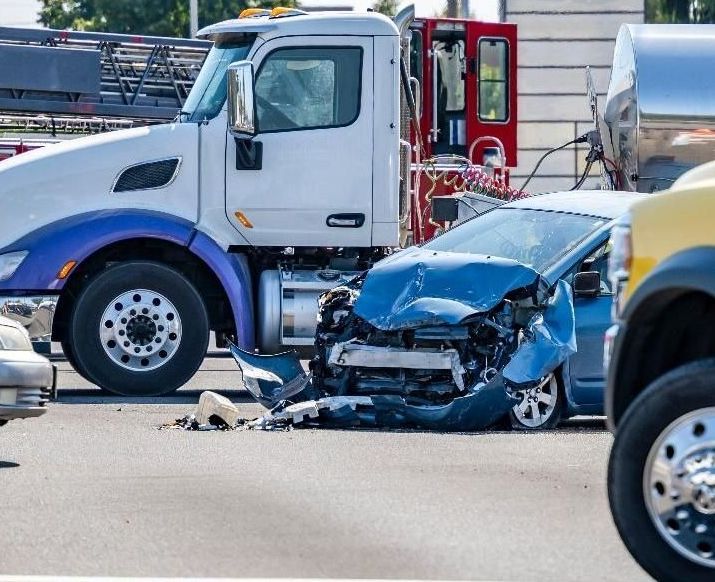

Personal injury cases can be financially and emotionally devastating for victims. When an individual suffers injuries due to someone else's negligence or intentional actions, they are often entitled to compensation for various damages, including medical expenses, pain and suffering, and loss of income.

In this article, the Houston personal injury lawyers at Wham & Rogers will explore two critical components of financial recovery in personal injury cases that are often underrepresented - lost wages and loss of earning capacity. These are two important elements of a victim’s life that could be changed irrevocably after an injury. Call Wham & Rogers at (832) 592-1108 to learn more about damages you may qualify for if you are injured.

Lost Wages and Loss of Earning Capacity

What an individual makes or is capable of making is only one part of their overall being. But for most of us, it is an important part of maintaining financial stability and the ability to plan for the future and provide for our families. That’s why it is so important to consider these two types of damages that may be awarded in a personal injury claim.

Lost Wages

Lost wages refer to the income that a victim would have earned had they not been injured in the accident or incident that led to their personal injury case. It is important to note that lost wages can encompass various forms of income, including salary, hourly wages, bonuses, and other benefits. Here's how lost wages are typically calculated:

- Current Lost Wages: The most straightforward aspect of lost wages calculation is the income the victim has already lost due to their inability to work. This is relatively easy to calculate based on the victim's employment records, including pay stubs and tax returns.

- Future Lost Wages: When injuries result in long-term or permanent disability, the victim may be unable to work in the same capacity as before. In such cases, the calculation becomes more complex. An expert, often an economist, may be consulted to determine the potential earnings the victim would have received over their lifetime had the injury not occurred. This includes factors such as salary growth, expected career advancement, and inflation.

- Mitigation: The injured party is also expected to make reasonable efforts to mitigate their losses by seeking alternative employment or pursuing vocational rehabilitation if possible. Failure to mitigate can affect the amount of compensation awarded.

Loss of Earning Capacity

Loss of earning capacity differs from lost wages in that it pertains to the victim's ability to earn income in the future, taking into account the impact of their injuries. This concept recognizes that an injury may limit or even prevent the victim from engaging in their previous profession or career. Here's how loss of earning capacity is typically determined:

- Medical Assessments: Medical experts play a significant role in assessing the extent of the victim's injuries and the expected limitations they will face in the future. This information is crucial for estimating the impact on their earning capacity.

- Vocational Expert Opinions: Vocational experts are often consulted to evaluate the victim's work history, skills, and abilities. They can provide insights into how the injuries may affect the victim's ability to perform their job or seek new employment.

- Economic Analysis: Economists use a combination of factors, including the victim's age, occupation, projected career trajectory, and the severity of the injury, to calculate the potential loss of earning capacity. They can also consider factors like inflation, discount rates, and retirement age.

- Present Value: The projected loss of earning capacity is usually converted into a present value, representing the value of future income streams in today's dollars.

Importance of Expert Testimony

In personal injury cases, both lost wages and loss of earning capacity require expert testimony to establish the extent of the financial damages. Medical professionals, vocational experts, and economists can provide vital insights that help the court or negotiating parties understand the full scope of the victim's financial losses.

Other Types of Damages in Personal Injury Cases

In personal injury cases, lost wages and loss of earning capacity are crucial components of the victim's financial recovery. But they are not the only type of damages that are often awarded to victims. Here are some common damages awarded in personal injury claims:

Economic Damages

- Medical Expenses: This includes compensation for past and future medical bills related to the injury, such as hospitalization, surgeries, doctor's visits, prescription medications, rehabilitation, and medical equipment.

- Property Damage: If the injury resulted in damage to the victim's property, such as a car in a motor vehicle accident, they can seek compensation for repair or replacement costs.

- Rehabilitation Costs: In cases where the injured party requires ongoing therapy, physical or occupational rehabilitation, or counseling, the cost of these services can be covered.

- Household Services: If the victim is temporarily or permanently unable to perform household tasks or chores due to the injury, they may be compensated for the cost of hiring help.

- Transportation Expenses: Expenses related to traveling for medical appointments or other necessary services can be included in economic damages.

Non-Economic Damages

- Pain and Suffering: This category includes compensation for physical pain, emotional distress, and psychological suffering resulting from the injury. The amount awarded can vary significantly based on the severity of the injury and its impact on the victim's life.

- Emotional Distress: Victims can seek compensation for the emotional and psychological trauma they experienced as a result of the injury, such as anxiety, depression, and post-traumatic stress disorder.

- Loss of Consortium: In cases where the injury has negatively impacted the victim's relationship with their spouse or family members, damages may be awarded to compensate for the loss of companionship, affection, and support.

- Loss of Enjoyment of Life: This damage category accounts for the loss of the victim's ability to participate in activities and hobbies they enjoyed prior to the injury.

- Disfigurement or Scarring: If the injury resulted in permanent physical disfigurement or scarring, victims may receive compensation for the negative impact on their appearance and self-esteem.

- Loss of Reputation: In certain cases, damage to a person's reputation due to the injury can be considered when awarding compensation.

- Punitive Damages: In rare cases, punitive damages may be awarded to punish the at-fault party for particularly egregious conduct and to deter similar behavior in the future.

To understand the full extent of the damages a victim may be entitled to, individuals pursuing a personal injury claim should consult with an experienced attorney who can provide guidance and legal expertise.

Get Help with Your Personal Injury Case

If you are considering filing a personal injury lawyer, it is important to work with a skilled Houston personal injury lawyer. While valuing some damages may be fairly straightforward – such as medical expenses - the complexities of lost wages and loss of earning capacity requires the knowledge and experience of a skilled legal team.

At Wham & Rogers, we are more than just personal injury lawyers. We are fierce advocates for victims and their legal rights. Our Board-Certified personal injury attorney has recovered millions of dollars for victims of negligence. If you are suffering an injury, we can help!

Get started with a free consultation by calling us at (832) 592-1108, or by completing our online contact form.

The information on this website is for general information purposes only. None of the information on this site should be taken as legal advice for any individual case or situation. This information is not intended to create, and receipt or viewing does not constitute, an attorney-client relationship.